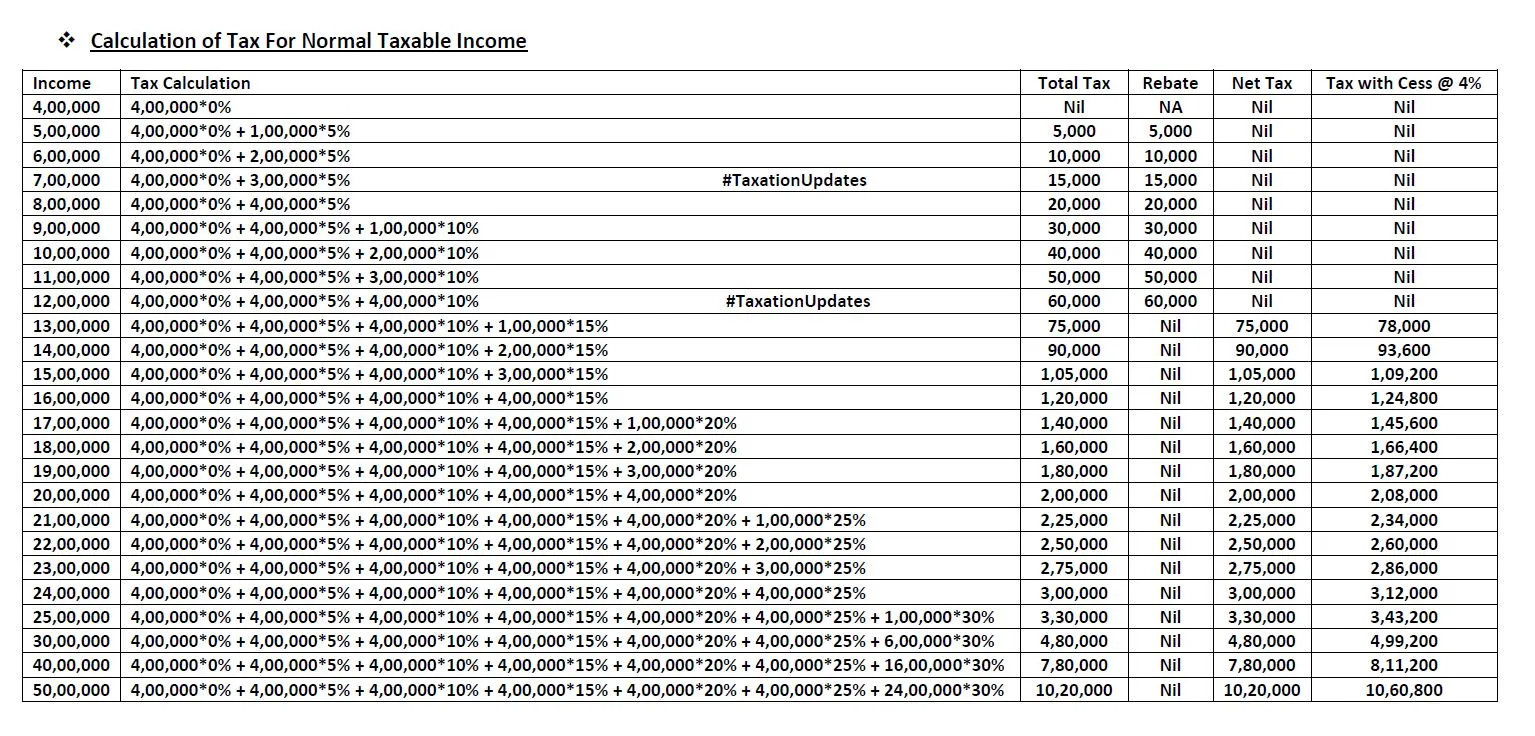

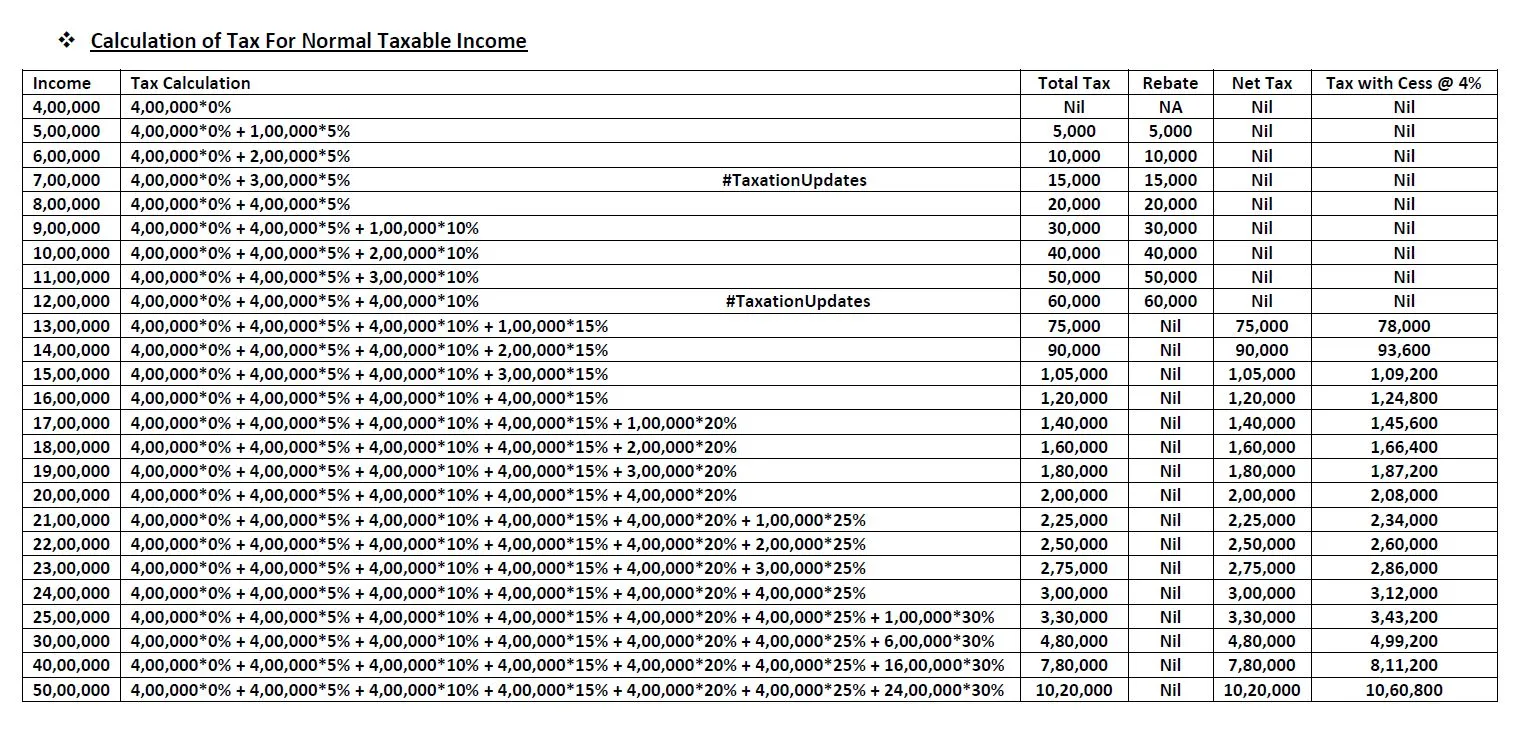

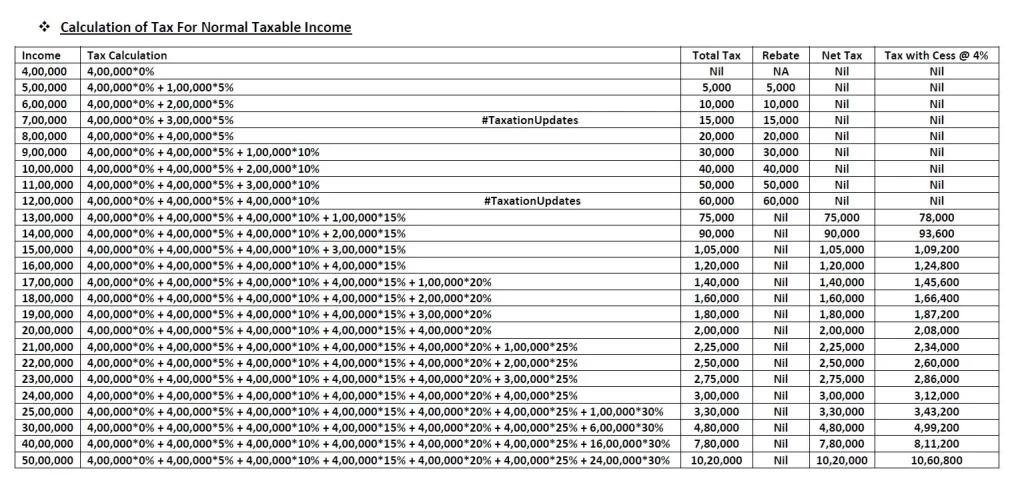

New Delhi: Finance Minister Nirmala Sitharaman has changed the income tax slabs under the new tax regime in Union Budget 2025. These changes will be effective from April 1, 2025, for FY 2025-26. The new tax slabs are as follows: Income up to Rs 4 lakh – Nil tax, Rs 4 lakh to Rs 8 lakh – 5%, Rs 8 lakh to Rs 12 lakh – 10%, Rs 12 lakh to Rs 16 lakh – 15%, Rs 16 lakh to Rs 20 lakh – 20%, Rs 20 lakh to Rs 24 lakh – 25%, and above Rs 24 lakh – 30%. Taxpayers can save up to Rs 1.14 lakh annually under the new regime, which will continue as the default option.

Now, individuals can choose between the old tax regime and the new one based on what suits their financial needs best. Here is a simple explanation of both regimes, their features, tax slabs, and examples to help you understand them better.

New Tax Regime 2025-2026

The new tax regime offers lower tax rates but has fewer exemptions and deductions. It is ideal for those who prefer simplicity and do not invest heavily in tax-saving schemes.

Income Tax Slabs (FY 2025–26 / AY 2026–27)

| Up to Rs 4,00,000 | 0 Tax |

| Rs 4,00,001 to Rs 8,00,000 | 5% |

| Rs 8,00,001 to Rs 12,00,000 | 10% |

| Rs 12,00,001 to Rs 16,00,000 | 15% |

| Rs 16,00,001 to Rs 20,00,000 | 20% |

| Rs 20,00,001 to Rs 24,00,000 | 25% |

| Above Rs 24,00,000 | 30% |

Key Features of the New Tax Regime

- Higher Exemption Limit: Income up to Rs 4,00,000 is tax-free.

- Section 87A Rebate: Income up to Rs 12,00,000 is tax-free due to a rebate of Rs 60,000.

- Default Option: If taxpayers don’t choose a regime, they are automatically placed under the new regime.

- Limited Deductions: Popular deductions like those under Section 80C, 80D, and 80TTA are not available.

- Standard Deduction: Rs 75,000 is allowed.

- Employer’s NPS Contribution: Deduction increased to 14% of basic salary.

Example Calculation (FY 2024–25)

- Gross Income: Rs 20,00,000

- Deductions:

- Standard Deduction: Rs 75,000

- Employer’s NPS Contribution: Rs 2,00,000

- Net Taxable Income: Rs 17,25,000

Tax Calculation:

- Rs 4,00,000 → 0% = Rs 0

- Next Rs 4,00,000 → 5% = Rs 20,000

- Next Rs 4,00,000 → 10% = Rs 30,000

- Next Rs 4,00,000 → 15% = Rs 30,000

- Remaining Rs 2,25,000 → 30% = Rs 67,500

Total Tax: Rs 2,07,500

Cess (4%): Rs 8,300

Final Tax Liability: Rs 2,15,800

Read also:

- Top 7 Best Railway Stocks to Buy in India For 2025

- Trent Share Price Target 2025 to 2030:

- Ticker Tape in Stock Trading

Old Tax Regime

The old regime allows taxpayers to claim various deductions and exemptions, making it suitable for individuals who invest heavily in tax-saving schemes.

Income Tax Slabs (For Individuals Below 60 Years)

| Up to Rs 2,50,000 | 0 Tax |

| Rs 2,50,001 to Rs 5,00,000 | 5% |

| Rs 5,00,001 to Rs 10,00,000 | 20% |

| Above Rs 10,00,000 | 30% |

Note: Higher exemption limits are available for senior citizens:

- Aged 60–80 years: Rs 3,00,000

- Above 80 years: Rs 5,00,000

Example Calculation (FY 2024–25)

- Gross Income: Rs 17,00,000

- Deductions:

- Section 80C: Rs 1,50,000

- Section 80CCD(1b): Rs 50,000

- Section 80D: Rs 25,000

- Section 80TTA: Rs 10,000

- Net Taxable Income: Rs 14,65,000

Tax Calculation:

- Rs 2,50,000 → 0% = Rs 0

- Next Rs 2,50,000 → 5% = Rs 12,500

- Next Rs 5,00,000 → 20% = Rs 1,00,000

- Remaining Rs 4,65,000 → 30% = Rs 1,39,500

Total Tax: Rs 2,52,000

Cess (4%): Rs 10,080

Final Tax Liability: Rs 2,62,080

Comparison: New vs. Old Regime

| Income Range | Old Regime | New Regime |

|---|---|---|

| 0 – Rs 2,50,000 | 0% | 0% |

| Rs 2,50,001 – Rs 5,00,000 | 5% | 5% |

| Rs 5,00,001 – Rs 7,00,000 | 20% | 5% |

| Rs 7,00,001 – Rs 10,00,000 | 20% | 10% |

| Rs 10,00,001 – Rs 12,00,000 | 30% | 15% |

| Rs 12,00,001 – Rs 15,00,000 | 30% | 20% |

| Above Rs 15,00,000 | 30% | 30% |

How to Choose Between the Two Regimes

- Evaluate Deductions: If you claim many deductions (e.g., 80C, 80D), the old regime may be better.

- Simplicity: The new regime is easier to calculate and manage.

- Flexibility: Salaried individuals can switch regimes yearly, but business taxpayers have restrictions.

Final Thoughts

Choosing the right regime depends on your financial goals and income. Use an updated tax calculator or consult a professional to make an informed decision. By understanding both regimes, you can plan your taxes effectively and minimize your tax liability.