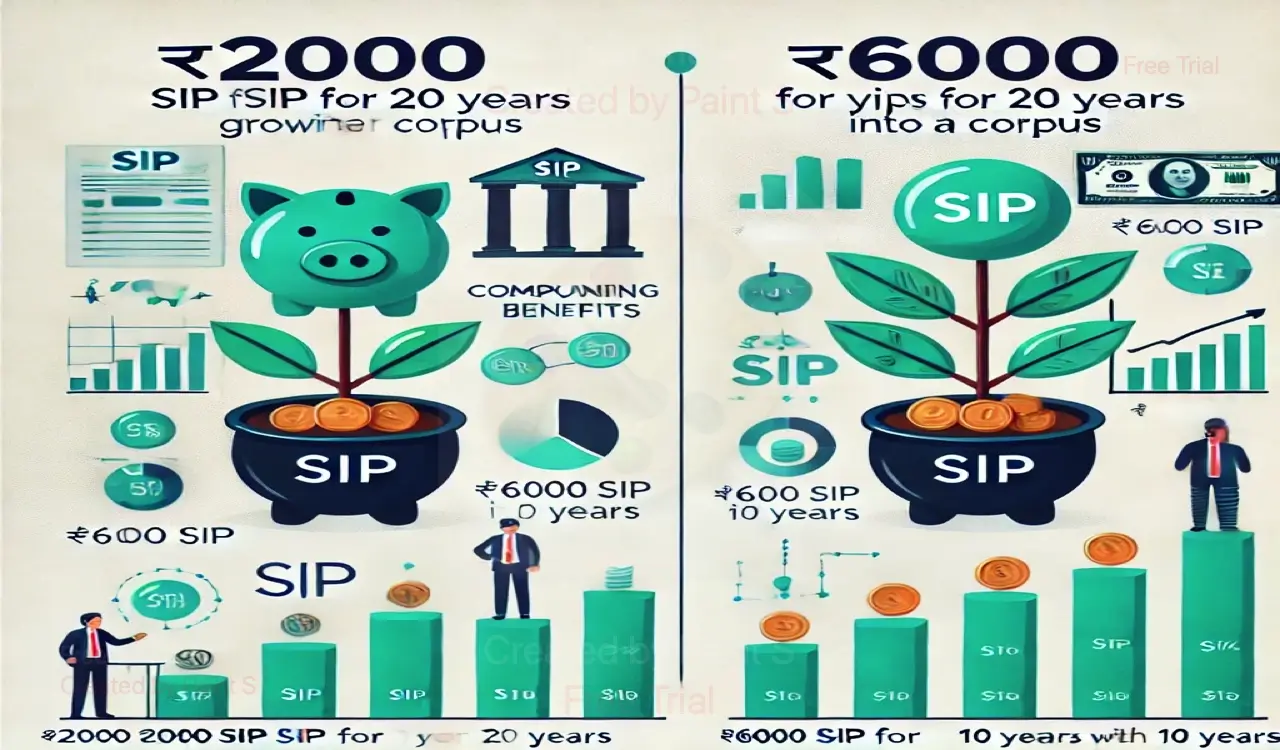

Systematic Investment Plans (SIPs) are one of the best ways to invest in mutual funds. They allow disciplined investment while taking advantage of rupee cost averaging and compounding. Many investors face a common problems like:

- Should they invest a smaller amount for a longer period?

- Or a larger amount for a shorter duration?

In this article, we will compare two SIP investment scenarios:

- Investing ₹2000 per month for 20 years

- Investing ₹6000 per month for 10 years

By analyzing expected returns, power of compounding, and final corpus, we will determine which approach can generate a bigger wealth over time.

Understanding the Power of SIP Investments

SIP works on the principle of compounding, which means the returns earned are reinvested to generate further returns. This snowball effect is stronger when the investment period is longer.

Key Factors Affecting SIP Returns

- Investment Duration – The longer you stay invested, the more compounding works in your favor.

- Monthly SIP Amount – A higher amount contributes to a larger corpus, but time plays a crucial role.

- Expected Return Rate – Equity mutual funds historically provide returns in the range of 10-15% p.a.

- Market Volatility – Shorter SIP durations are more affected by market fluctuations than long-term SIPs.

Now, let’s calculate the expected corpus for both cases.

Case 1: ₹2000 SIP for 20 Years

Investment Details:

- Monthly SIP: ₹2000

- Investment Duration: 20 years

- Expected Rate of Return: 12% (Assumption based on past market trends)

Using the SIP formula:

Maturity Amount = P × [(1 + r)^n – 1] × (1 + r) / r

Where:

- P = Monthly SIP investment

- r = Monthly return rate (Annual rate/12)

- n = Number of months

Let’s calculate the corpus for different return rates:

| Return Rate | Estimated Corpus |

|---|---|

| 10% | ₹15.35 lakh |

| 12% | ₹19.92 lakh |

| 14% | ₹26.14 lakh |

At 12% return, the investor accumulates around ₹19.92 lakh after 20 years.

Case 2: ₹6000 SIP for 10 Years

Investment Details:

- Monthly SIP: ₹6000

- Investment Duration: 10 years

- Expected Rate of Return: 12%

Since the investment amount is three times higher but the duration is half, let’s see how the corpus builds up.

| Return Rate | Estimated Corpus |

|---|---|

| 10% | ₹12.34 lakh |

| 12% | ₹13.94 lakh |

| 14% | ₹15.91 lakh |

At 12% return, the investor accumulates around ₹13.94 lakh after 10 years.

Comparing the Two SIP Strategies

| SIP Plan | Total Invested | Duration | Corpus at 12% Return |

|---|---|---|---|

| ₹2000 for 20 yrs | ₹4.8 lakh | 20 yrs | ₹19.92 lakh |

| ₹6000 for 10 yrs | ₹7.2 lakh | 10 yrs | ₹13.94 lakh |

Observations:

- The ₹2000 SIP for 20 years results in a bigger corpus (₹19.92 lakh) compared to ₹6000 SIP for 10 years (₹13.94 lakh).

- Even though the second investor contributes ₹2.4 lakh more, their corpus is smaller because compounding works better over longer durations.

- The investor with the 20-year SIP benefits from additional years of compounding, leading to higher returns.

Read also: Best Credit Card in India for Salaried Persons (2025)

Why Long-Term SIP Works Better?

- More Time for Compounding:

- Even with a lower amount, a longer duration allows earnings to reinvest and grow exponentially.

- In the last few years, the returns grow significantly due to exponential compounding.

- Market Volatility Averaging:

- Longer SIP investments reduce the impact of market fluctuations.

- Short-term SIPs might see losses if markets remain bearish for some years.

- Better Risk Management:

- A long-term SIP approach helps in mitigating risk and balancing market ups and downs.

What If You Extend ₹6000 SIP for 20 Years?

If the ₹6000 SIP was continued for 20 years, the corpus would be:

| Return Rate | Estimated Corpus |

|---|---|

| 10% | ₹46.05 lakh |

| 12% | ₹59.76 lakh |

| 14% | ₹78.42 lakh |

This proves that a higher SIP amount with a longer duration can create massive wealth. However, if you have limited funds, investing for a longer period still yields better results.

Read also: FD या Mutual Fund: कौन बेहतर है? पूरी जानकारी हिंदी में

Conclusion: Which SIP Strategy Is Better?

✔ ₹2000 SIP for 20 years is better than ₹6000 SIP for 10 years due to the power of compounding.

✔ Investing early and staying invested for a long period helps in building a bigger wealth corpus.

✔ Even if you have a small amount, starting early is the key to wealth creation.

Thus, if you are wondering which SIP plan to choose, opt for a longer duration rather than just increasing the investment amount for a short period. Happy investing! 🚀, You can calculate yourself by visiting this link.