GAIL Share Price Target: When it comes to making smart investments in the stock market, knowing the potential of a company’s share price is crucial. If you’re considering investing in GAIL (Gas Authority of India Limited), understanding its future growth potential and share price target for the years ahead can help you make a more informed decision.

This article will provide an overview of what you need to know about GAIL’s share price target for tomorrow and for the years 2025 to 2030.

GAIL Share price target?

GAIL (India) Limited is a state-owned natural gas processing and distribution company in India. Established in 1984, it has grown to become one of the largest companies in the Indian gas industry. It is bluecheap company like other(IRFC, HDFC, TCS) GAIL is involved in the transportation, distribution, and trading of natural gas. Additionally, the company has a significant presence in petrochemicals, liquid hydrocarbons, and LNG (Liquefied Natural Gas).

Here we provide GAIL Share target for tomorrow 2025 to 2030, with full analysis like current market trends, what should you do, brokerage few and lots more:

GAIL’s Share Current Performance

Before jumping into predictions about GAIL’s share price for 2025 to 2030, it’s essential to understand the company’s current position in the market.

| GAIL | As on 22 Jan, 2025 | 15:59 |

|---|---|

| Open price | ₹ 176 |

| High price | ₹ 180.62 |

| Low price | ₹ 172.00 |

| Previous Close | ₹ 179.91 |

| Volume | 9,583,003 |

| PE Ration | 10.01 |

| Div. Yield | 3.12% |

| 52 week Heigh/Low | ₹ 246/164 |

| Market Cap | ₹ 1,16,024 Cr. |

| Current view | Under weight |

GAIL Share Price Target performance largely depends on

- 1. Gas Distribution: GAIL is the largest natural gas pipeline company in India, and its extensive network plays a significant role in its revenue.

- 2. Petrochemical and LPG Business: GAIL’s involvement in petrochemical production and LPG distribution adds to its diversification, helping the company spread out its risks.

- 3. LNG: With the growing demand for natural gas in India, GAIL’s investments in LNG and associated infrastructure are a positive factor for future growth.

As of recent reports, GAIL’s revenue and profits have been on a steady rise, driven by the increase in the demand for natural gas in India. Moreover, GAIL’s government backing also adds stability to its stock.

### Key Factors Influencing GAIL Share Price target

There are several factors that influence the share price of GAIL. As an investor, understanding these will give you insights into the stock’s potential for growth in the coming years:

1. Gas Pricing

The price at which GAIL buys and sells natural gas affects its profitability. Higher gas prices can lead to increased margins, pushing the share price upward.

2. Government Policies

GAIL is a public-sector company, so government policies regarding the gas industry, subsidies, and price regulations play a crucial role in shaping its financial performance.

3. Market Demand:

As the demand for natural gas increases, particularly for power generation and industrial usage, GAIL is likely to benefit. The increasing focus on cleaner energy alternatives also strengthens the position of companies like GAIL in the market.

4. Infrastructure Expansion:

GAIL’s pipeline infrastructure and its expansion plans can positively affect its future growth. More pipelines mean more gas can be transported, leading to higher revenues.

5. International Trade and LNG Imports:

GAIL’s participation in LNG imports and international trade also influences its market performance. Global trends in LNG demand and prices directly impact GAIL’s financial results.

#GAIL Share Price Target for Tomorrow

If you’re thinking of investing in GAIL in the short term, it’s essential to understand how the stock is performing currently and what experts predict for tomorrow. As per recent trends, GAIL’s share price has been relatively stable, but slight fluctuations are common in the stock market.

Tomorrow’s GAIL share price will likely depend on:

- Market Sentiment: Any news or developments related to the gas sector, changes in gas prices, or government policies could impact investor sentiment.

- Macroeconomic Factors: The performance of the overall stock market, inflation rates, or interest rate changes could also have a short-term effect on GAIL’s stock.

Tomorrow GAIL share price may be in range betwwen – Rs.180 to 190

Given its stability, it’s expected that GAIL’s share price tomorrow might see a minor shift upwards depending on these external factors. However, since GAIL has a solid foundation, its short-term outlook is likely to remain positive.

### GAIL Share Price Target tomorrow 2025 to 2030

Looking ahead to 2025 and beyond, GAIL has strong potential for growth, provided that key factors such as natural gas demand, government policies, and infrastructure development play out positively.

| Year’s | GAIL Share price Target |

|---|---|

| 2025 | Rs. 270 (Maximum) |

| 2026 | Rs. 310 – 345 |

| 2027 | Rs. 300 – 450 |

| 2028 | Rs. 400 -425 |

| 2029 | Rs. 450 |

| 2030 | Rs. 500 |

Disclouser: I am not a registered stock analyst with NSE/BSE, nor do I hold any license from any government authority for the same. The information provided here is entirely based on my personal analysis and thoughts. All the content shared on this platform is strictly for educational purposes only. The views expressed here are solely my personal opinions. Before making any investment, please conduct your own research or consult a professional financial advisor.

Below are some insights for the 2025 to 2030 period:

1. Rising Demand for Natural Gas: As India moves toward cleaner energy sources, natural gas is expected to play a key role in the energy mix. GAIL, being a dominant player, is well-positioned to benefit from this rise in demand.

2. Expansion Plans: GAIL is investing in expanding its gas pipeline network and enhancing its LNG infrastructure. These investments will contribute to long-term growth and, in turn, positively impact the share price.

3. Diversification into Renewable Energy: The company is exploring renewable energy sources like wind and solar, which could further boost its growth potential. Diversification can help GAIL maintain stability even if the natural gas sector faces challenges.

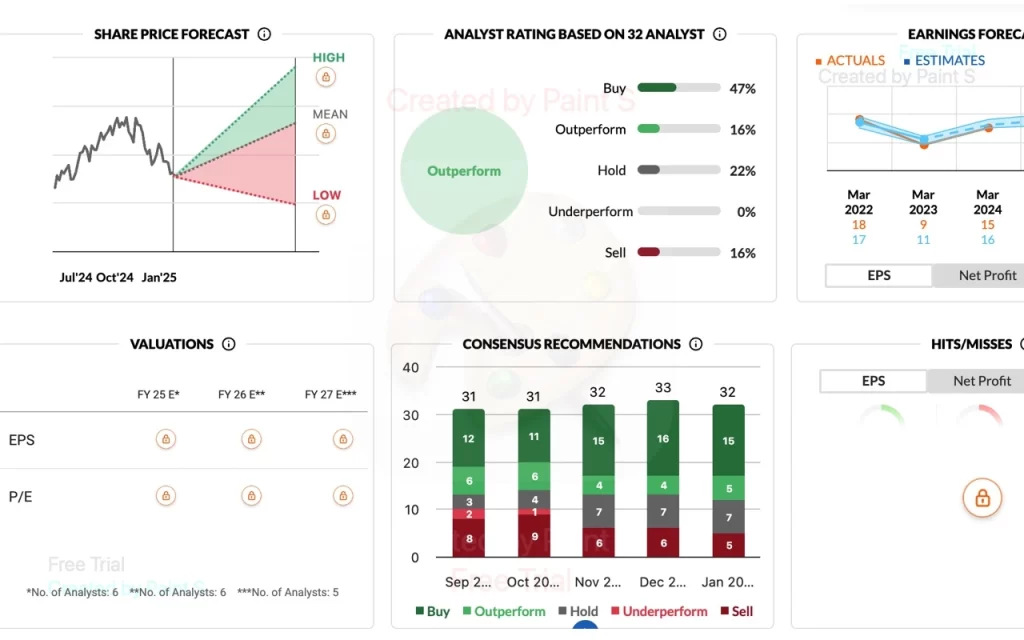

# Expert Predictions for GAIL’s Share Price target (2025 to 2030)

Several analysts predict that GAIL’s share price will likely see steady growth in the coming years. Based on the company’s fundamentals, here’s what experts foresee:

– By 2025:

It’s expected that GAIL’s share price could rise to approximately ₹220–₹240 per share. This would be driven by continued demand for natural gas and the completion of major infrastructure projects.

– By 2030:

Over the next 5 years, if GAIL continues to perform well and expand its operations, its share price could reach ₹350–₹400. Factors such as government policies supporting natural gas and the company’s investment in LNG and renewable energy could significantly boost this target.

#Should You Invest in GAIL?

If you’re considering GAIL as an investment option, here are a few key things to keep in mind:

1. Long-Term Growth Potential

GAIL’s solid market position, stable earnings, and growth in the natural gas sector make it a strong candidate for long-term investments.

2. Moderate Risk

While GAIL’s performance has been stable, the stock is still subject to market fluctuations, government regulations, and gas price volatility. Therefore, it’s important to be prepared for moderate risk.

3. Dividend Yields

GAIL is known for paying regular dividends, which is an attractive feature for long-term investors seeking passive income.

In conclusion, GAIL offers promising growth opportunities, but it’s important to assess your investment goals, risk tolerance, and market conditions before making any decisions. The share price target for 2025 to 2030 shows potential for healthy returns, making GAIL a worthwhile consideration for long-term investors.

Summary

GAIL (India) Limited is a leading state-owned company in the natural gas sector, benefiting from India’s increasing demand for cleaner energy. The company’s share price is influenced by factors such as gas pricing, government policies, market demand, and infrastructure expansion.

For 2025, experts predict GAIL’s share price could reach ₹220–₹240, potentially rising to ₹350–₹400 by 2030 due to its investments in LNG, pipeline infrastructure, and renewable energy.

While GAIL offers long-term growth potential and stable dividends, investors should note moderate risks. All views shared are personal and for educational purposes; conduct your research or consult an advisor before investing.